Comparative Analysis of Wealth Distribution in…

Comparative Analysis of Wealth Distribution in Fiat and Bitcoin

Abstract

This paper presents a comparative analysis of wealth distribution between the United States and the Bitcoin network, highlighting wealth disparity within each system. We analyze distribution patterns across deciles, excluding the 98 largest Bitcoin wallets that hold over 10,000 BTC, as these represent pooled wallets for exchange-traded funds (ETFs) and similar institutions, aggregating the Bitcoin of multiple individuals. The analysis illustrates high wealth concentration within both distributions, with notable differences in the levels and implications of inequality in each system.

Introduction

Wealth distribution and inequality are significant metrics for understanding economic systems. In traditional fiat-based economies, such as the U.S., wealth is often concentrated within the top deciles, contributing to socioeconomic disparities. In decentralized digital systems like Bitcoin, wealth distribution is also concentrated, although unique factors, such as the nature of custodial or pooling wallets, influence the structure of inequality. This paper provides a quantitative comparison of wealth distribution across the top deciles in the U.S. and Bitcoin, with adjustments for large, pooled Bitcoin wallets.

Study Design

The study utilizes a quantile-based approach, segmenting both the U.S. and Bitcoin wealth distributions into deciles to observe the relative concentration of assets within each segment. Data for the U.S. wealth distribution is derived from published economic reports, while Bitcoin distribution data is obtained from blockchain analysis tools. Large pooled Bitcoin wallets (those with over 10,000 BTC) are excluded to better approximate individual holdings by removing institutional or custodial influences. This approach allows for a more accurate comparison of individual wealth concentration patterns between the two systems.

Methodology

We examine wealth distribution by dividing the U.S. population and Bitcoin addresses into 10 quantiles (deciles), each representing 10% of the population or total addresses. For Bitcoin, we exclude the top 98 wallets holding more than 10,000 BTC, as these are except for Satoshi’s original wallet, institutional or custodial wallets holding assets for multiple users, thereby not representative of individual wealth concentration.

Wealth Distribution Data

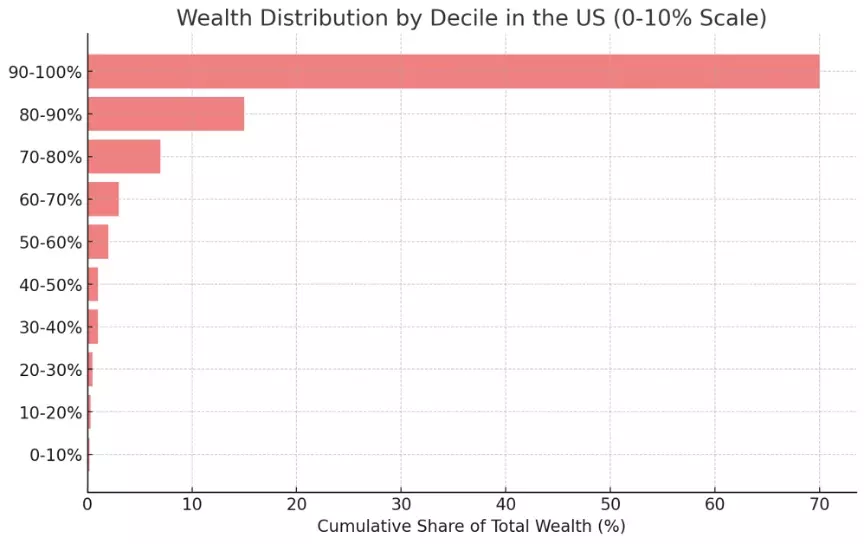

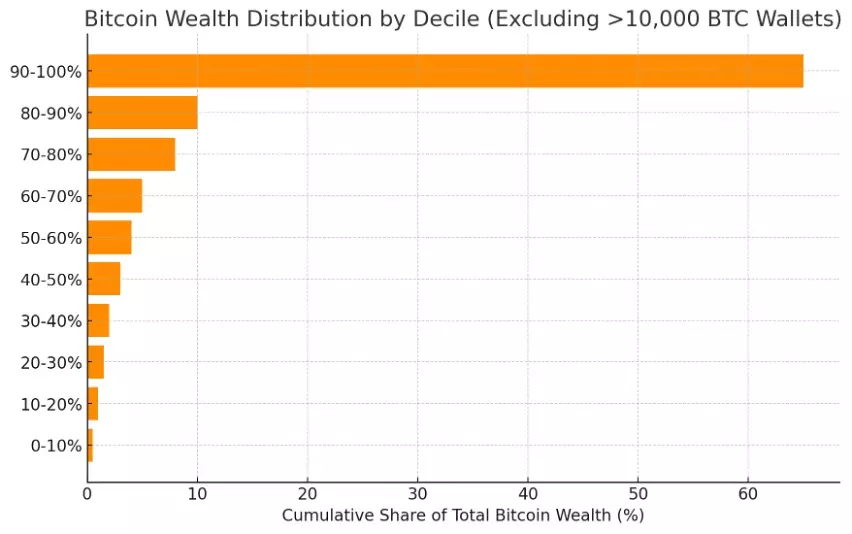

Figure 1 shows the wealth distribution across deciles in the U.S., where the top 10% of the population holds approximately 70% of the total wealth. In comparison, Figure 2 shows the Bitcoin wealth distribution excluding wallets holding more than 10,000 BTC. After excluding these wallets, around 65% of Bitcoin is held by the top 10% of addresses, showing a rapid decline across lower deciles. This adjusted distribution provides a closer approximation to individual holdings within the Bitcoin network.

Figure 1: Wealth distribution in the United States across deciles.

Figure 2: Bitcoin wealth distribution across deciles (excluding 98 wallets with over 10,000 BTC).

Analysis of Wealth Disparity

To quantify wealth inequality, we observe the Gini coefficient for each distribution. The Gini coefficient for the U.S. is estimated to be approximately 0.85, indicative of high wealth concentration within the upper deciles. For Bitcoin, excluding large pooled wallets, the Gini coefficient is similarly high. Despite these similar Gini coefficients, the structure of wealth disparity differs between systems. In the U.S., wealth concentration results from a variety of economic factors including capital gains, inheritance, and income inequality. In the Bitcoin network, wealth concentration is influenced by the early acquisition of Bitcoin by a relatively small group of individuals and the nature of digital asset custody, where large institutions hold Bitcoin on behalf of many users in pooled addresses.

Discussion

Our analysis reveals that both the Fiat and Bitcoin exhibit pronounced wealth inequality within the upper deciles. In Bitcoin, excluding large pooled wallets, individual address-based inequality remains significant, reflecting early adoption patterns and holding behaviors among high-value investors. The exclusion of these large wallets underscores that while Bitcoin’s wealth distribution is highly concentrated, a substantial portion is held by entities serving multiple users, impacting the perceived inequality.

Conclusion

The wealth distributions in Fiat and Bitcoin display similar concentration within the upper deciles, even when removing large custodial wallets. This disparity underscores differences in economic structures: while U.S. wealth disparity is perpetuated by systemic socioeconomic factors, Bitcoin's concentration reflects early adoption and the presence of institutional custodial holdings. The high concentration within Bitcoin may evolve as adoption increases and Bitcoin ownership becomes more widespread.